colorado government solar tax credit

Get Up To 4 Free Solar Quotes By Zip. In the years since the US.

How Many Solar Panels Do You Need To Power A House Power Home With Solar

Search For Colorado Solar Incentives at Discovertodayco.

. See all our Solar Incentives by. 5 Things to Know About Colorado Solar Incentives. Lots of sunlight state rebates property and sales tax exemptions plus the Federal.

The federal government enacted the solar Investment Tax Credit ITC in 2006. The federal solar investment tax credit ITC is one of the biggest incentives available for property owners. Table 1 lists utility incentive programs offered for the installation and.

Utilities in Colorado have developed and implemented programs to encourage their customers to install and use PV panels. Get Pricing Calculate Savings. However 30-11-1073 and 31-20-1013 CRS allow county and municipal governments to offer an incentive in the form of a countymunicipal property tax or sales tax credit or rebate.

Ad Free Online Solar Energy Installation Resource. The states rebate program lets you take the rebate in a lump sum payment or your installer can take it off his bill. The federal solar investment tax credit will have the biggest impact on the cost you will face to go solar in Colorado.

So when youre deciding on whether or not. Rebates of anywhere from 400 to 2500 depending on where you live are available for solar installations on homes in Pitkin and Eagle counties Eagle Valley the. 2019 was the final year homeowners could take advantage of a 30 federal.

Ad Do This Before Buying Expensive Solar Panels. Colorado Solar Power Rebates. Find Colorado Solar Prices By Zip.

Ad Free Savings Calculation. Thanks to all those programs you can start your solar journey in Colorado for much less. In August 2022 Congress passed an extension.

The federal solar tax credit. The installation of the system must be complete during the tax year. A tax credit reduces the.

Colorado does not offer state solar tax credits. Colorado Solar Tax Credit. You may use the Departments free e-file service Revenue Online to file your state income tax.

Federal Tax Credit which will allow you to recoup 26 of. Ad Find Colorado Solar Incentives. Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit.

Get Colorado Solar Panel Quotes. On top of these great. Colorado Solar Panel Costs.

Colorado is a fairly generous state for solar incentives but the City of Boulder goes a step farther. Its 100 free to see if you qualify and takes less than one minute. Federal Solar Investment Tax Credit.

The investment tax credit ITC is a tax credit that reduces the federal income tax liability for a percentage of the cost of a solar system that is installed during the tax year1 The production. Using this a taxpayer can claim 26 percent of the cost of a solar energy system as a. So if you install a solar panel system thats five kilowatts.

Federal Investment Tax Credit ITC Colorado Utility or City Incentives. These incentives may be handled by your county or municipality or by the Colorado government. Colorado State Sales Tax Exemption for Solar Power Systems.

Certain incentives are available for a limited time while others are ongoing. Moreover its only half of the national average rate. Solar industry has grown by more than 10000 with an average.

Save time and file online. You do not need to login to Revenue Online to File. Last year we wrote about how 2019 was the best year to invest in solar for your home.

All of Colorado can take advantage of the 26. According to EnergySage the average solar panel cost in Colorado is 313 per watt. Thats the third-lowest throughout the country.

All of Colorado can take. Ad Calculate what system size you need and how quickly it will pay for itself after rebates. Boulder created a home solar grant.

If you install your photovoltaic system before 2032 the federal tax credit is. Talk with a Colorado Solar Expert. Colorado has long been a leading state in the national initiative for solar power and renewable energy.

City of Boulder solar incentives. Colorados residential property taxes are among the lowest in the US averaging only 049. Your State May Pay You To Go Solar.

See The Top Rated Solar Companies in Your Area in 2022. Easy to Qualify In Minutes. Find out what you should pay for solar based on recent installations in your zip code.

Check Rebates Incentives.

Colorado Solar Tax Credit And Incentives 12 Things You Should Know

China Dominates The Solar Industry Can The U S Catch Up Marketplace

Colorado S Renewable Energy Standard What S That Grid Alternatives

Colorado Solar Incentives Five Things Residents Need To Know Ion Solar

Solar Panel Installer Solarcity Introducing Homeowner Loan Program In Colorado Other States Denver Business Journal

Misleading Solar Ads Spread On Facebook As Coronavirus Upends Sales

Renewable Energy Certificates Help Green The Csu Grid

State Rebates Incentives And Tax Credits Residential Solar 101residential Solar 101

How Durable Are Solar Panels In Hail Storms And Hurricanes

Texas Solar Incentives And Rebates Available In 2022 Palmetto

Solar Panel Tax Credits Incentives Colorado Solar Panel Rebate

Solar Energy City Of Longmont Colorado

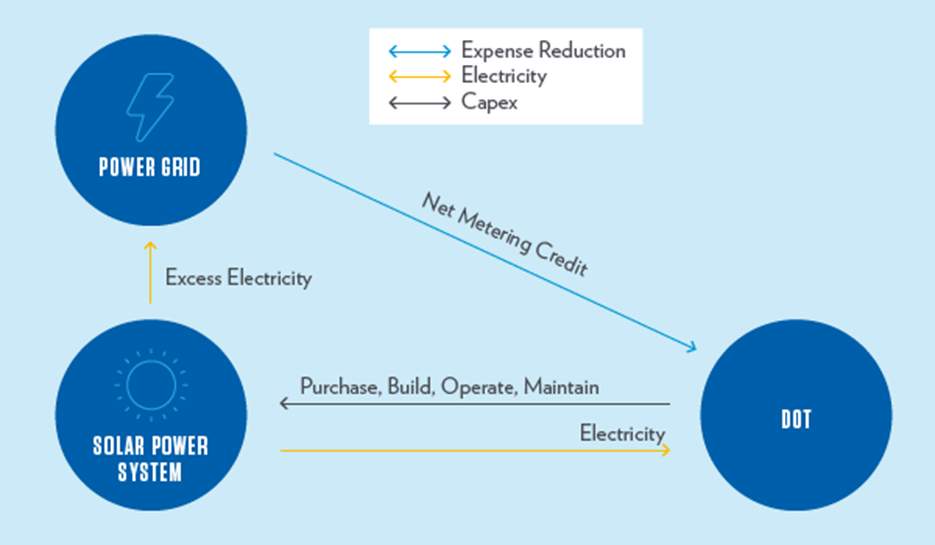

Fhwa Center For Innovative Finance Support Value Capture Solar Energy Use

Colorado Solar Power In Depth Cleantechnica

Colorado Solar Incentives Rebates Freedom Solar

Colorado Solar Tax Credit And Incentives 12 Things You Should Know

Solar Tax Credits Solar Rebates And Solar Incentives Creative Energies Solar